Content

For each of these approaches, you will need to be aware of your fixed costs, variable costs, and cost of sales. You can add new fixed or variable costs based on your business structure. Just replace _ADD NEW_ with the cost category and input the total cost for the time frame being analyzed. Again, total fixed and total variable costs will be summated for you.

- Once you’ve pulled up your total sales from your bar inventory platform or POS, the break-even calculations can begin.

- A break-even analysis provides a business with a clear idea of how much needs to be achieved in sales to avoid a loss and make a profit.

- Once sales teams with price flexibility understand the value of their product and know the minimum selling price, they can start to shape sales price ranges for different accounts.

- Break-even analysis can also help businesses see where they could re-structure or cut costs for optimum results.

- However, this is only useful when each unit sells for a set price.

After month 2, they’ve risen to $80,000, and to $90,000 by month 3. Trimming an organization’s fixed costs to decrease the break-even point. Reduced fixed costs represent a lower financial hurdle that needs to be cleared. Fixed costs are common targets for cost-cutting measures, such as office space consolidation, reducing ancillary costs such as office supplies, or restructuring staffing. The break-even point is the point at which a company’s revenue and expenses are equal — meaning, no profit but no loss.

What Is Break Even Point? [Definition, Meaning and Formula]

The process of determining the break-even point is a good time for a bar or restaurant to determine its true cost of doing business and its prices. The break-even calculation also gives management an expectation for the future. For instance, if the company broke even in July, the rest of the year’s operations would be generating pure profits.

You can then generate BEP reports and share them across your company to encourage different departments to implement actionable changes. The sales leaders want to know the number of vacuum cleaners they’d Breakeven Point Bep Definition need to sell to break even on their quarterly expenses so they can set sales metric targets for Q2. Between insurance costs, salaries, property taxes, and leasing, the fixed quarterly costs are $120,000.

Examples of Break-Even Analysis

It’s actually quite easy if you’ve got all your bar inventory and sales numbers ready to go. Knowing your restaurant’s break-even point gives you a financial polestar. Every decision you make, before profitability, should be geared toward hitting your restaurant’s break-even point. A company could explore multiple paths regarding its products’ development and launch. Break even analysis is also essential for a company planning an expansion to a new territory or entering new markets. Break even analysis is the technique of determining the break even point for a product taking into account several other factors.

- When a manufacturing business buys new production equipment, it replaces variable labor costs with a fixed cost.

- The break-even point refers to the amount of revenue required to cover a business’s fixed costs and variable costs which means it helps you develop e.g. a pricing strategy.

- Break-even analysis shows the relationship between costs, profit and volume and the point at which financial equilibrium — where total revenue equals total costs — is achieved.

- Most companies can crunch the numbers, but challenges abound in the tracking and categorization of revenue and expenses — many of which can be mitigated by advanced accounting software.

- Once a company manages to break above the breakeven point, it can be said that it is starting to make profits.

All the numbers you need to run a profitable liquor program are waiting for you in BinWise. Book a demo and you’ll see how easy it is to forecast, plan, and execute a successful operation. We can even show you how to perform a swot analysis for a restaurant or use our restaurant financial audit checklist for further analysis.

Cost Analysis

The breakeven point for a trade or investment is determined by comparing the market price of an asset to the original cost; the breakeven point is reached when the two prices are equal. There are two approaches that may be used to determine a company’s break-even point, often known as the BEP. It may be calculated in terms of physical units, such as production volume, or it https://quick-bookkeeping.net/kennedy-introduces-bill-expanding-louisiana/ can be calculated in terms of monetary value, such as sales value. This means understanding your break-even cost is vital to calculate the break-even point and move beyond it into profit. Unlike other formulas, you need to make sure to account for every single cost you incur or your break-even point will not be calculated properly and you may end up missing out on profits.

What is BEP defined as?

The break-even point is the point at which total cost and total revenue are equal, meaning there is no loss or gain for your small business. In other words, you've reached the level of production at which the costs of production equals the revenues for a product.

If you produced 10,000 copies of a book at a cost of $5 per unit, then you would reach your Break-Even Point once you have achieved $50,000 in sales of that book. The excess of total sales over sales at bep is referred to as contribution. For example, let us consider a company where sales amount to $80,000 and variable cost is $40,000. In this case, contribution which refers to the difference between the sale price and variable cost will be $40,000. It can therefore be said that contribution is the difference between the sale price and variable cost.

Raising sales prices to increase the unit CM, which causes the break-even point to drop. Many sales and marketing strategies can be effective for raising the sales price of an item, including elimination or reduction of discounts. Financial break-even point puts a different spin on the same underlying concept. Financial break-even point occurs when a company’s earnings, before interest and taxes, would result in zero earnings per share.

What is BEP and its formula?

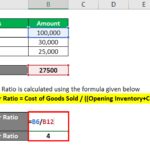

Break-Even Point (Units) = Fixed Costs ÷ (Revenue per Unit – Variable Cost per Unit) When determining a break-even point based on sales dollars: Divide the fixed costs by the contribution margin.